New condos, buy or lease?

Owner commitment

To get a better idea, we spoke to Jean-François Ferland a real estate broker at RE/MAX. If a person has the financial stability to do so, Jean-François recommends buying, which includes numerous advantages, including a certain amount of the money spent going back into the owner’s pocket; you save money, without even realizing it.

“One must understand that with today’s low interest rates, a large amount of your mortgage payment goes directly towards your mortgage principal. While paying your condo for two, three or four years, you are, in fact, paying yourself back thousands of dollars in principal. When it comes time to sell, you profit from this principal; this is what I refer to as a forced savings plan,” explains Jean-François.

To illustrate this, he offers the following example: A condo bought for $250 000 with a 5% down payment and an interest rate of 2.24% over 25 years, monthly. Following the $12 500 down payment, the person’s monthly payments will be $1 131. 84. “The condo in question costs just a bit more than renting, but every month it is as though you were putting away $700 or $800.”

Ownership also offers other privileges, according to Jean-François Ferland, such as flexibility and comfort. “As an owner, you can make key decisions. The day you decide to make some improvements to your condo, you are the one that will benefit. For example, if you decide to renovate your kitchen, upon selling your condo, this investment will profit you. The same renovations made in a rental property, only benefit the owner in the long run.”

What happens if you buy a condo and then, for whatever reason, you run into some financial issues? “The Montreal condo market is booming right now, so you can always consider leasing or selling your condo, to lighten your load.”

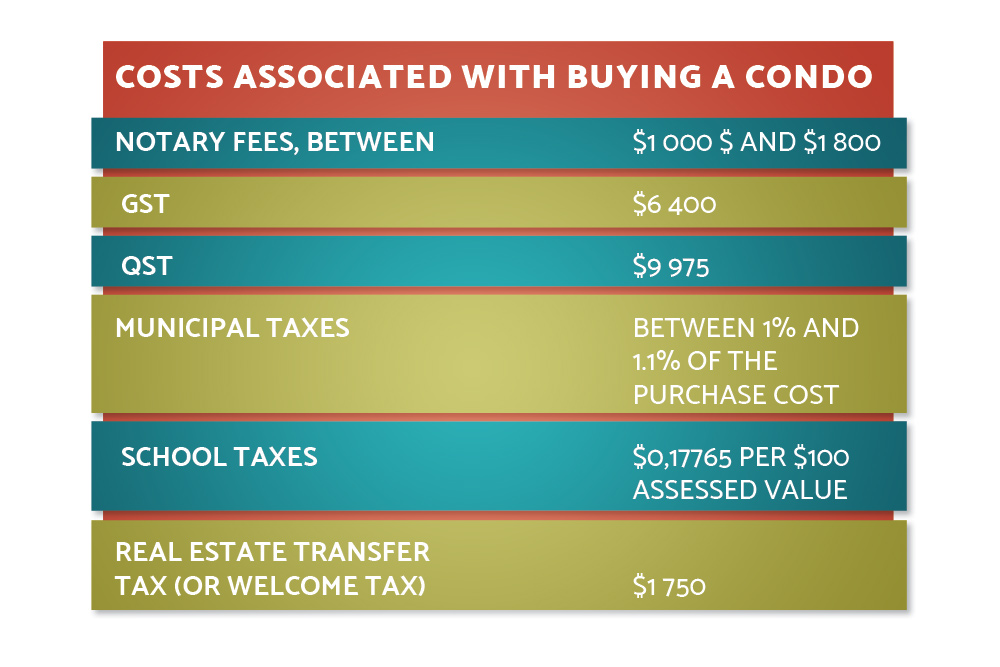

Before taking any important decisions, it is imperative to assess your needs and evaluate your repayment capacity. Relying only on financial institutions to evaluate your economic status is a huge mistake; they frequently offer their clients too high a margin loan. By considering additional purchase costs, organisations such as the ACEF (Associations coopératives d'économie familiale) or a financial planner are best suited to help you evaluate your actual borrowing capacity. Here is an example of applicable costs on a $200 000 condo:

Rent or buy costs calculator here

Tenant freedom

Opting to rent is often associated to financial, professional or emotional insecurity… Nowadays, new, all-inclusive, simple concepts are available to appeal to tenants. Globetrotters, people on the move and workaholics are often attracted to this formula. In fact, many people opt to simplify their lives by renting in new, high end buildings. Benefitting from this formula is easy… the only cost is a fixed rate split over 12 months. What is the catch? When the tenant rings in the new year, the only things left are memories, not a dime remains in his or her pocket.

Let’s be honest, the key is to carefully and objectively analyse your financial situation. Owning, even a new condo, involves some surprises and requires funds to deal with the unexpected. In Quebec, it is suggested that your allocated housing budget should not exceed 32% of your gross income. You should use this as a starting point before visiting and falling in love with your dream condo that is either for sale or for rent…